ECB Cuts Interest Rates Again: March 2025 Financing Update

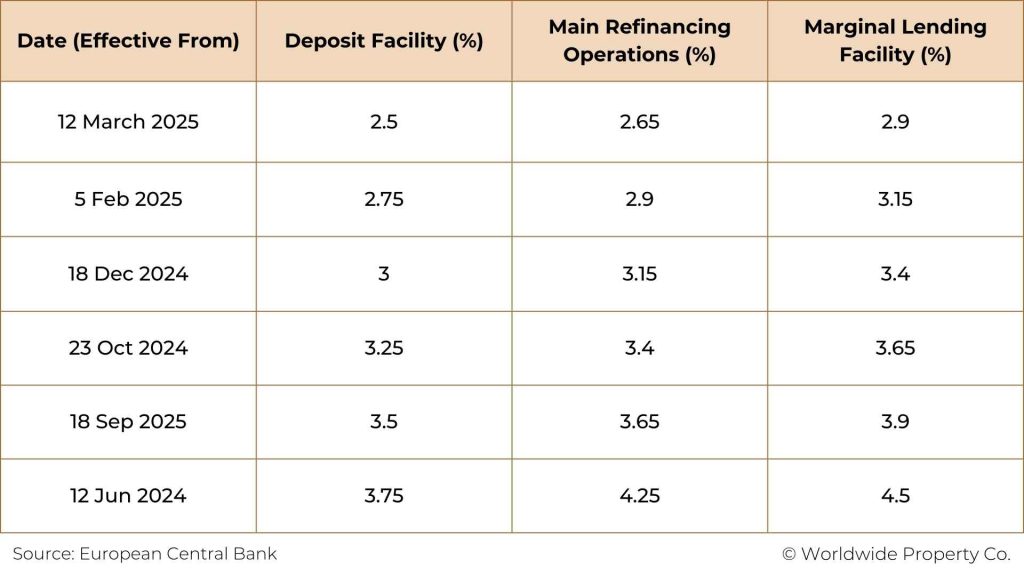

The European Central Bank (ECB) has announced another interest rates cut of 0.25%, effective from 12 March 2025. This marks the fifth rate cut in the last nine months, as the ECB continues to adjust its monetary policy to support economic stability. The new key interest rates are as follows:

- Deposit facility rate: 2.50%

- Main refinancing operations rate: 2.65%

- Marginal lending facility rate: 2.90%

This decision comes as the ECB also revises its economic growth forecasts downwards, signalling a cautious approach to fostering economic recovery while maintaining inflation control. The central bank remains committed to achieving its target inflation rate of 2%, ensuring long-term economic stability across the eurozone.

ECB Interest Rates From June 2024 to March 2025

ECB Impact on Mortgage Rates

This latest ECB rates cut is expected to have a positive effect on European mortgage rates, making financing more affordable for property buyers and investors. At Worldwide Property Co, we specialise in assisting clients with international property purchases and financing solutions. This change presents new opportunities for both new buyers and existing property owners.

Benefits for New Buyers

- Lower Borrowing Costs: A reduced ECB rate translates to lower interest rates on new mortgages, making property purchases more affordable.

- Increased Purchasing Power: With lower financing costs, buyers may afford larger or higher-value properties, expanding their investment potential.

Advantages for Current Property Owners

- Variable-Rate Mortgages: Property owners with variable-rate mortgages will likely see a decrease in their monthly repayments, leading to potential long-term savings.

- Refinancing Opportunities: Those with existing loans may have the chance to refinance at more competitive rates, securing better terms on their mortgages.

Considerations for Fixed-Rate Mortgages

It’s important to note that fixed-rate mortgage holders will not experience immediate changes in their repayments. Their current interest rates will remain locked for the agreed term, but they may still explore refinancing options if conditions remain favourable.

ECB’s Strategic Adjustments

Beyond interest rates, the ECB continues to assess its broader financial strategy, balancing liquidity in the market to maintain economic stability. These measures are part of a long-term effort to support controlled inflation and sustainable growth across the eurozone while aligning with the 2% inflation target.

How This Impacts Your Investments

The ECB’s latest rate reduction offers valuable opportunities for property buyers and investors. At Worldwide Property Co, we are here to guide you through these changes, helping you secure the most competitive mortgage rates and investment strategies.

Whether you’re looking to purchase a new property or refinance an existing mortgage, now is an excellent time to explore your options.

For further details, check the official ECB announcement and reach out to us to discuss how you can benefit from these market changes.