Council Tax Doubling on UK Second Homes: Buying Property Abroad Becomes Even More Attractive

From 1st April 2025, over 200 councils across England and Wales — including well-known second-home locations like Cornwall & Devon — will introduce a 100% council tax premium on second homes. For example, owners of a typical Band C property in Cornwall, annual council tax bills could rise from £2,186 to £4,372.

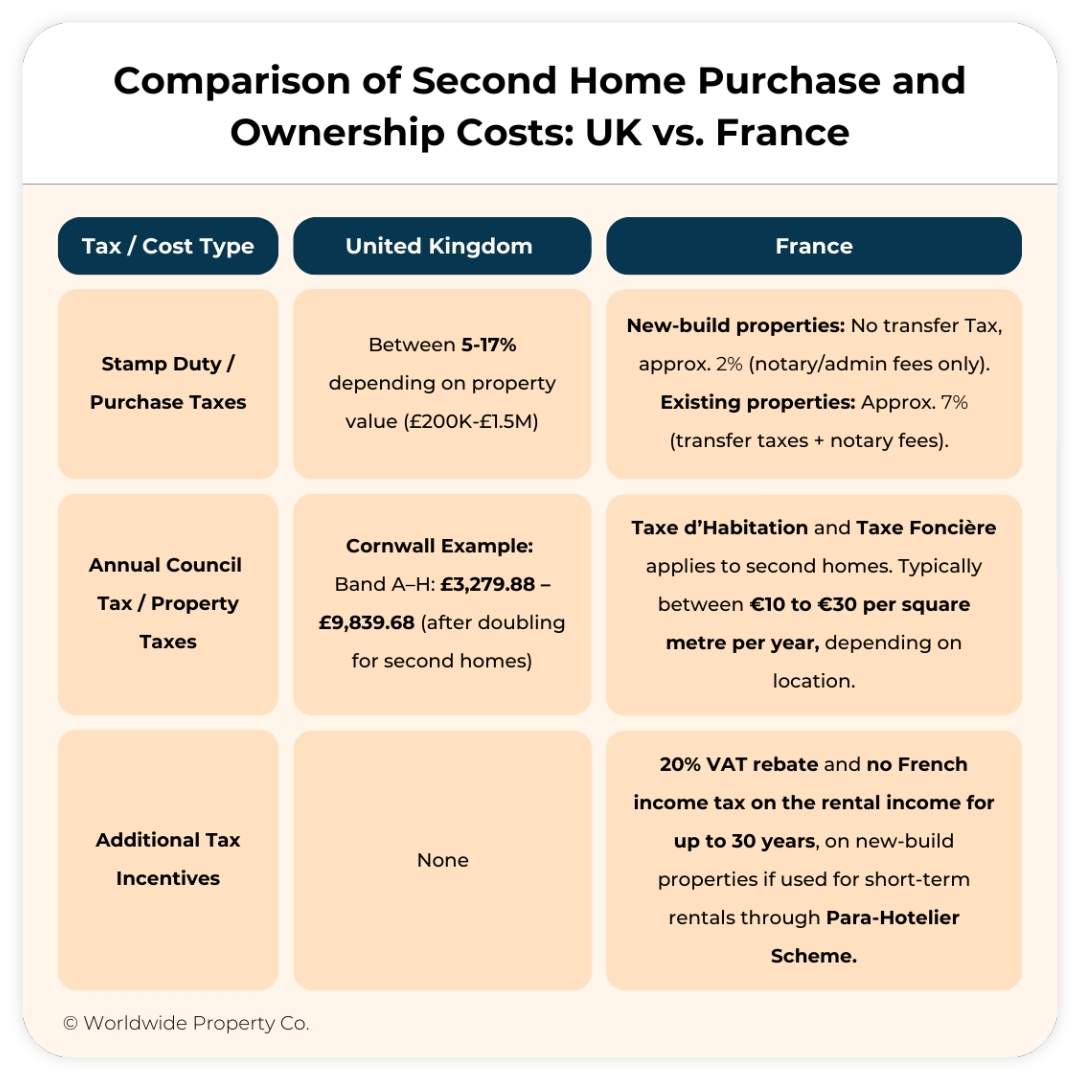

This comes on top of the higher stamp duty rates introduced at the end of last year, where second-home buyers now face rates of up to 17% for properties above £1.5 million. Together, these changes are having a significant impact on both current owners and those considering purchasing a second home in the UK.

The Rising Cost of Second Homes in the UK

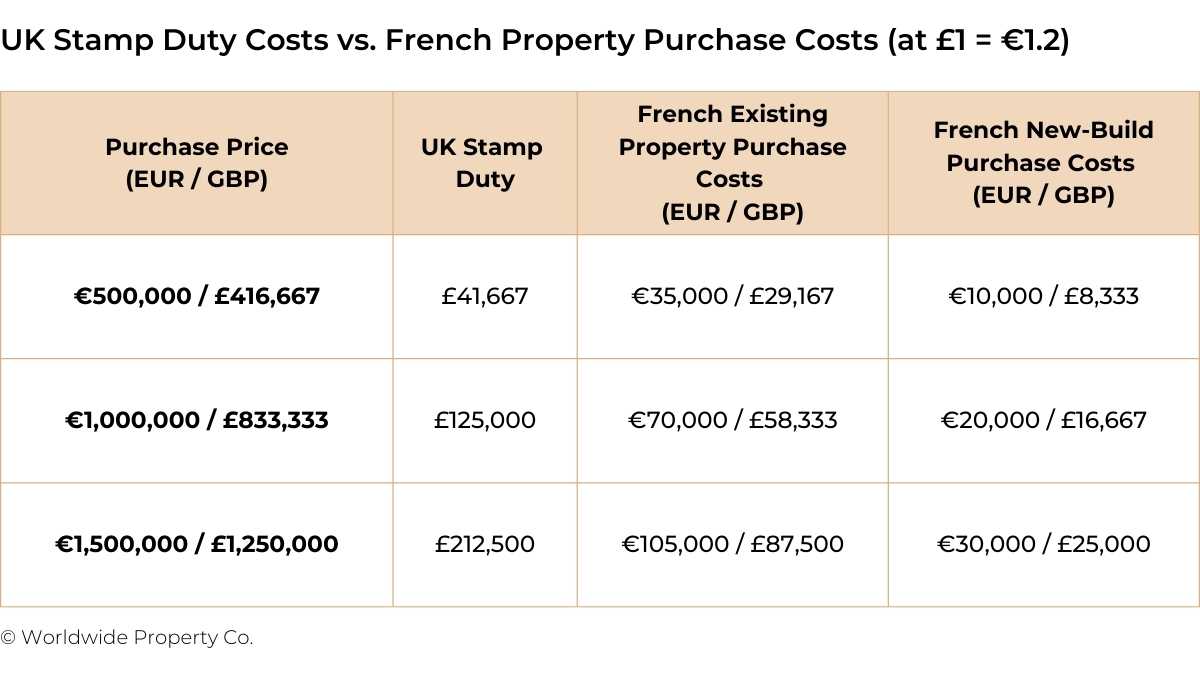

To highlight the difference in acquisition costs, here is a direct comparison between UK stamp duty and French property purchase costs for second homes. In the UK, second-home stamp duty rates are now as high as 17%, while in France, purchase costs for existing properties are typically around 7%, and for new-builds, approximately 2%.

In France, the total purchase costs for property purchases are inclusive of all taxes, legal fees, and administrative fees, providing a transparent view of the full financial commitment.

Why More UK Owners Are Turning to Properties Abroad

The combination of higher purchase costs and rising annual council tax is prompting owners and buyers to consider second homes abroad, where the cost structure is often more favourable — particularly in France.

Key Benefits of Buying New-Build Properties in France

- No stamp duty — only notary and administrative fees (around 2–2.5%).

- Two-year exemption from property tax (Taxe Foncière).

- No capital gains tax after 22 years. Rewarding long term ownership.

Tax Incentives if You Let Your Home While Not Staying There

- 20% VAT rebate when the property is used for short-term holiday lets under the French government’s Para-Hotelier scheme.

- Earn tax-free rental income by offsetting 80% of the property’s value as depreciation over 30 years.

Strategic Considerations for Buyers and Current Owners

Many of our clients are now reassessing whether their money is best placed in UK second homes, given these recent tax increases. International markets, particularly in high-demand areas like the French Riviera & Alps, present a compelling alternative — offering lower acquisition costs, attractive tax incentives, and stronger rental potential.

In addition, resorts like Tignes and Val d’Isère are investing heavily in year-round infrastructure, increasing both lifestyle benefits and year-round rental opportunities.

How We Can Help

At Worldwide Property Co., we help our clients make informed decisions when buying property abroad. Whether you\’re looking to diversify your investments or reconsider your current second-home strategy, we can assist with sourcing the right property, arranging tailored financing, and guiding you through every step of the purchase.

Contact us today if you would like to explore second home opportunities in France or other key European markets.