Tax in Mauritius: Advantages & Benefits of Property Investing

Mauritius is an increasingly attractive destination for international investors, thanks to its favourable tax policies, investor-friendly property regulations, and residency incentives. Whether you’re looking to relocate, invest in real estate, or establish a business, Mauritius offers a tax-efficient environment. This guide explores the key tax advantages and benefits of property investing in Mauritius, including the latest tax rates and exemptions for foreign residents.

Mauritius’ Tax System: An Overview

Mauritius operates under a progressive income tax regime, with tax rates ranging from 0% to 20%, depending on annual earnings. This system ensures a low tax burden for individuals and businesses, making it an appealing jurisdiction for investors and expatriates.

Taxation on Mauritian-Sourced Income

Income tax in Mauritius applies only to income sourced within Mauritius.

- Residents are taxed on their Mauritius-sourced income and foreign income only if remitted to Mauritius.

- Non-residents are taxed only on their Mauritius-sourced income, such as rental income from Mauritian properties or earnings from local business activities.

- Mauritius has also eliminated the previous 25% solidarity levy on high-income earners, further simplifying the tax structure.

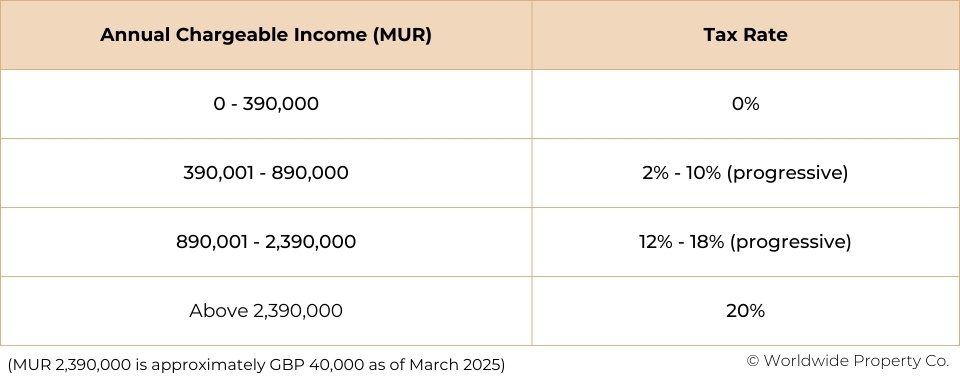

Current Income Tax Rates (2024)

Below is a detailed breakdown of the progressive income tax rates for 2024:

Key Tax Advantages for Property Investors

1. No Capital Gains Tax

Investors in Mauritius do not pay capital gains tax on the sale of property. This allows real estate owners to sell at a profit without additional tax liabilities, making it an attractive long-term investment option.

2. No Inheritance or Wealth Tax

Mauritius has no inheritance tax or estate duties, ensuring seamless wealth transfer to heirs without additional tax burdens. Additionally, there are no annual wealth taxes on assets held in Mauritius.

3. No Tax on Dividends

Foreign residents in Mauritius are not subject to any dividend tax, whether on local dividends or international dividends. This makes Mauritius a highly attractive destination for investors seeking to maximise their income without additional taxation on dividend earnings.

4. No Annual Property Tax

Unlike many countries, Mauritius does not impose annual property taxes. Once you own property, there are no ongoing tax liabilities related to ownership, except for applicable municipal rates in certain regions.

5. Foreign Income is Taxed Only on Remittance

Mauritius only taxes foreign income if it is remitted to the country. This means investors can earn income abroad without paying tax in Mauritius, unless they choose to transfer funds into the country.

Take Advantage of Mauritius’ Tax Benefits Today

Mauritius stands out as a premier investment and lifestyle destination, offering a low-tax environment and attractive property incentives. With no capital gains tax, no annual property tax, and a favorable income tax structure, Mauritius provides unparalleled benefits for investors and expatriates. If you’re considering investing in Mauritius real estate, our team can guide you through the buying process and help you secure the best opportunities.

Contact us today to explore the top investment properties in Mauritius.

Legal Disclaimer: The information in this guide is for general purposes only and not financial advice. Consult a tax professional before making investment decisions.

Further Reading on Investing in Mauritius

For a more comprehensive understanding of investing in Mauritius, explore these related guides:

- Living in Mauritius: Why Invest in Real Estate? – Discover the lifestyle and investment potential of Mauritius.

- How To Buy Property in Mauritius – A step-by-step guide on purchasing real estate in Mauritius.

- Mauritius Visa & Residency Incentives (Golden Visa) – Learn about residency options, for property investors, entrepreneurs, and retirees.