Budget Update: Second Homes Overseas Now More Attractive for UK Buyers

Over the past few years it has become increasingly more expensive to own a second home in the UK. In the recent budget, the Chancellor has now also increased the amount of stamp duty payable on second homes and investment properties. This has made owning a holiday home overseas even more attractive.

UK Stamp Duty Rates for Second Homes

For buyers in the UK, stamp duty on second homes and investment properties has increased, the new rates are as follows:

- Up to £250,000: 5%

- £250,001 – £925,000: 10%

- £925,001 – £1.5 million: 15%

- Above £1.5 million: 17%

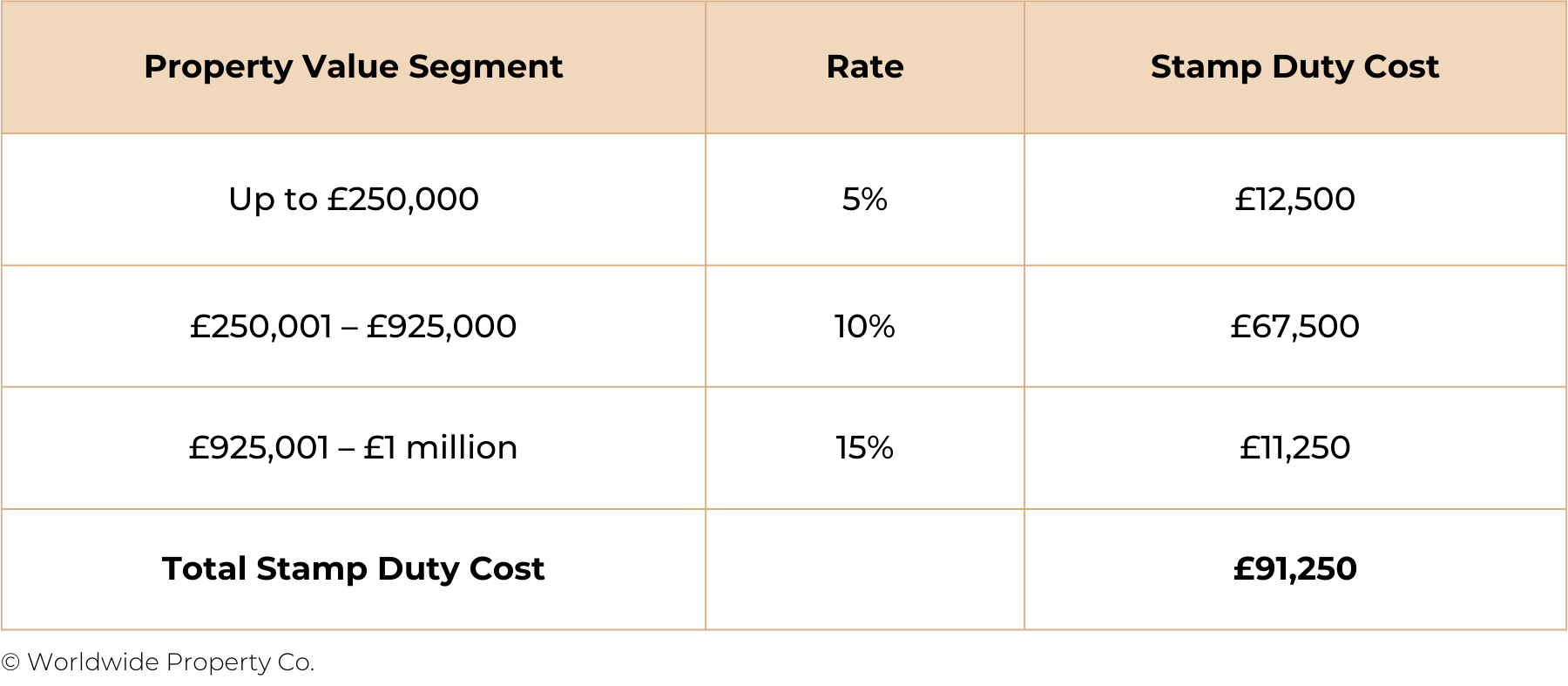

Example: Stamp Duty Costs For A £1,000,000 Second Home in the UK 2024

Purchasing a £1 million second home in the UK incurs a stamp duty cost of £91,250. This figure only covers the stamp duty itself and does not include other property-related expenses, such as legal fees and additional transaction costs, which would increase the total acquisition cost further.

Second Home Purchase Costs in Val d’Isère or Cannes

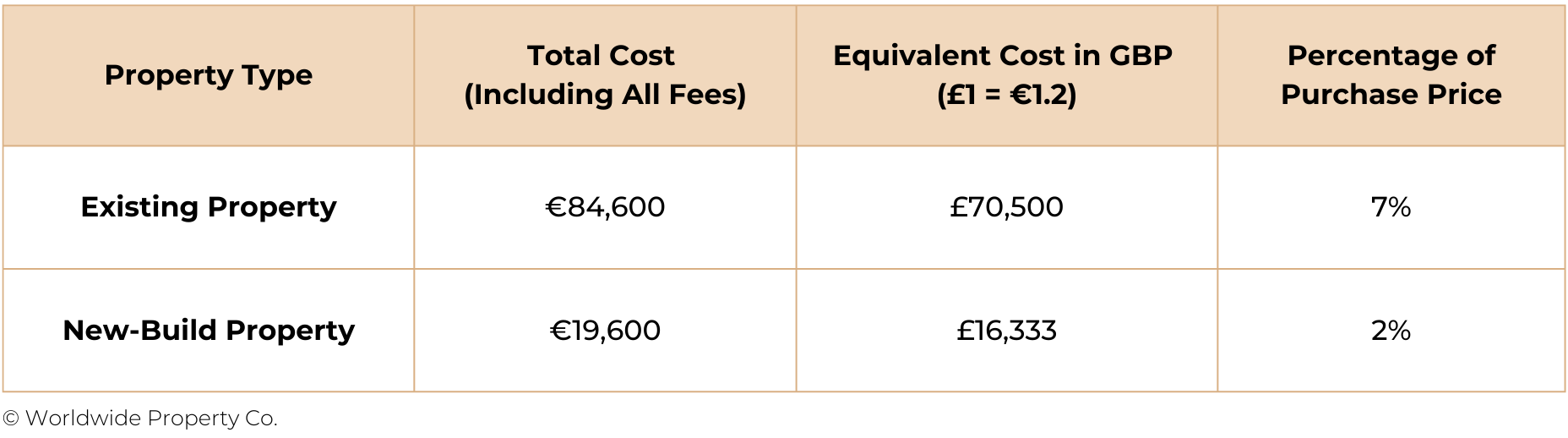

Example: Total Purchase Costs for a €1,200,000 Second Home in Val d’Isère or Cannes

In France, the total purchase costs for property purchases are inclusive of all taxes, legal fees, and administrative fees, providing a transparent view of the full financial commitment.

Additional Tax Advantages for New-Builds in France

In addition to lower acquisition costs, the French government’s Para-Hotelier scheme provides substantial tax benefits for new-build properties:

- VAT Rebate: Buyers can reclaim 20% VAT on the purchase price of any new build residential property in France.

- Tax-Free Rental Income: There is no French income tax on any rental income for up to 30 years.

- Capital Gains Tax: Reduces down to 0% after 22 years, encouraging long term investment.

To find out more about this incentive, please read our Para-Hotelier guide by clicking here.

How We Can Help You Find Your Ideal Second Home Overseas

At Worldwide Property Co., we’re your all-in-one solution for seamlessly buying property overseas. With our expertise, you can take advantage of France’s lower purchase costs and unique tax incentives on new builds. From finding your ideal home to securing tailored financing, we help you save time, money, and avoid the pitfalls.

Contact us today to start your journey toward owning the perfect second home abroad.